+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

Let’s face it. Almost everything we do is for our children. And all of us wish we had insights into why they do, what they do. This Children’s Day our thoughts are on helping us, help our children face their future! All of us have heard our parents exhorting us to save. They tell us to save for the future, for the unknown, and for our own good. They have seen a tough life in the olden days when jobs were tough to get and keep. Incomes were far too low while expenses remained high and most of the country was poor, requiring frugality and tight-fisted choices. I have heard tales of how my parents bought rationed sugar and had their coffee without sugar because I required the sugar at the age of 3. They have suffered just to ensure that we get better than they did.

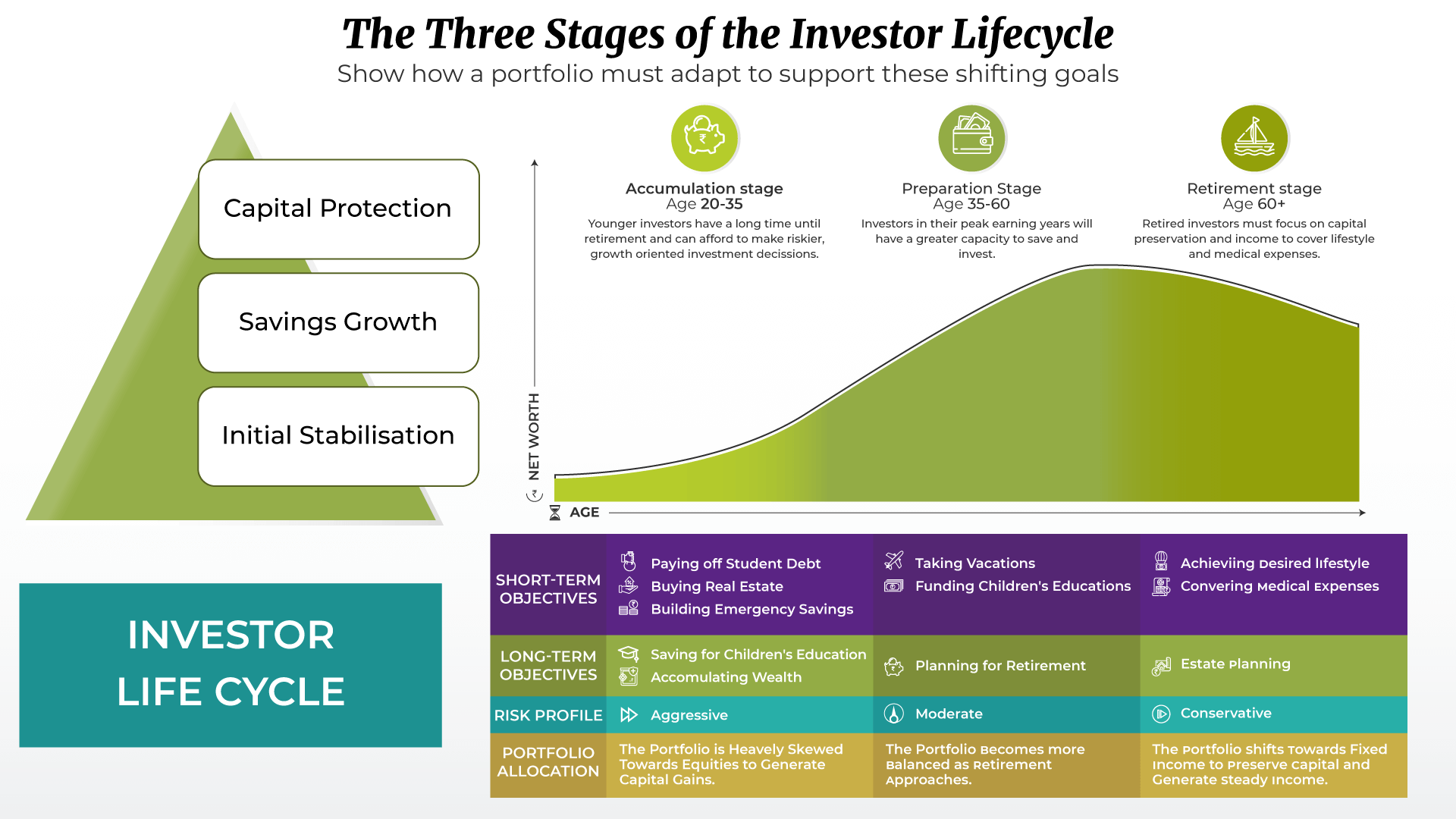

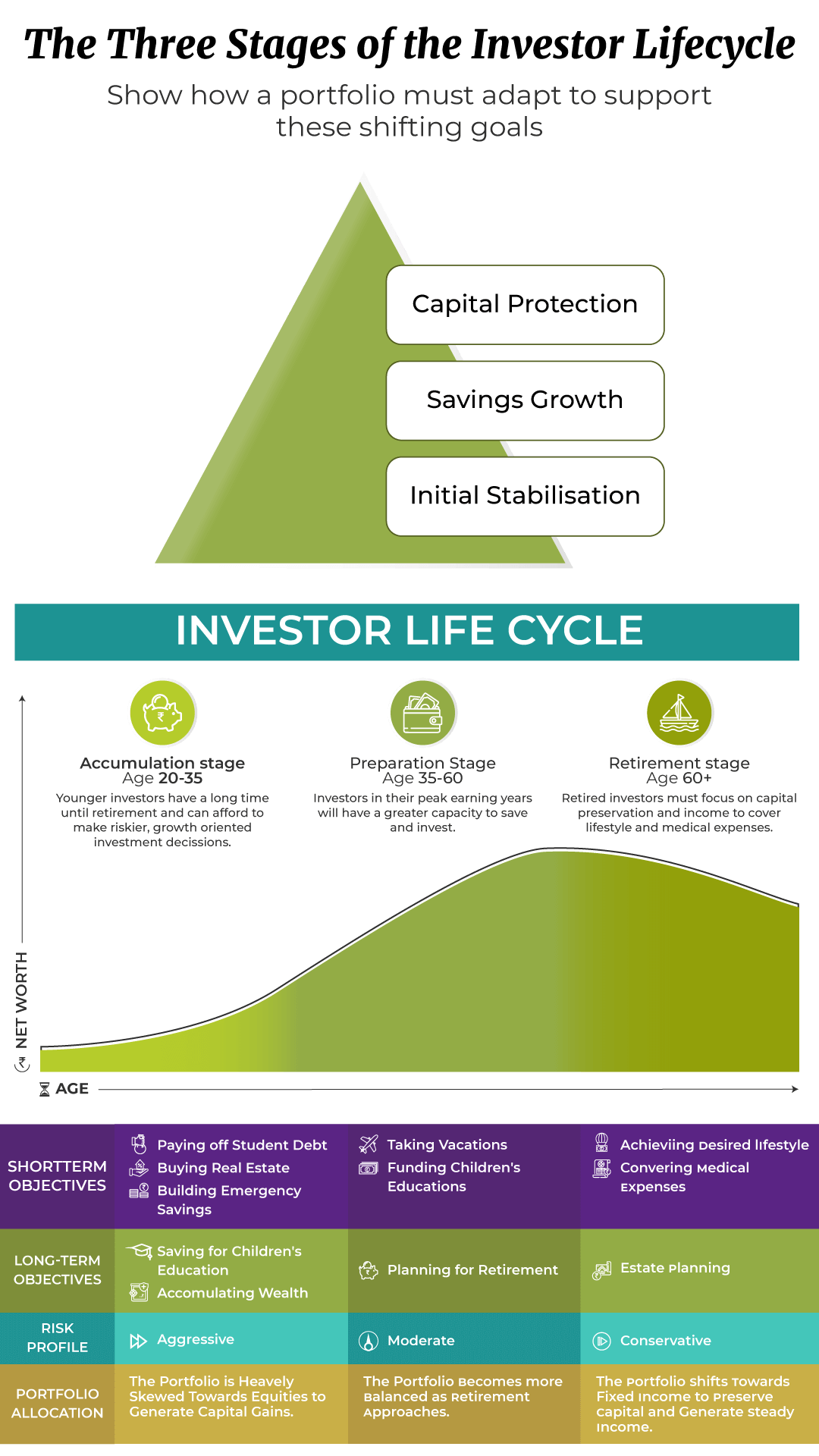

A financial adviser tells the young earner that this is the right age to start saving for retirement, but retirement? It seems so far off and unimportant from their current perspective.

It is tough for the youth to save because it is a trait primarily triggered by apprehension about the future and worry about finances. Young India does not see its future with pessimism. They have confidence in their ability to earn, to find another job, to change careers, and pursue dreams.

The crisis of 2008 and Covid have brought home the perils of not saving enough, and households have now inched back to putting aside money for a possible pessimistic tomorrow. The moral of the story is that saving is not natural behavior for the millennials. Pre-emptive savings are not floating their boat. Spending is, and with a renewed vigor in EMIs and easier access to the stock market, we see a confident generation eager to take on the world.

Youth are impatient and want to take charge of their lives. They like visibility for the future. In the past being an engineer or a doctor or a lawyer were the preferred vocational choices. Today with the plethora of choices, they are often fighting the demons of wrong choices regarding their education and career, always trying to set things right dreading returning to their parents for funding.

The incentive to save comes naturally when they direct it towards an immediate personal goal, such as studying for a better course in a better place to get that better job with that known company. They need counselling that helps them put aside a portion of their savings to do this. They need to be protected from investing in the stock market or in commodity trading trying to make quick money in the 2–3-years’ time frame they have.

Youth are always looking at the trade-off of spending vs. saving. And this trade-off is mostly unacceptable to them. Tell a newly employed youth that staying with the parents saves money in rent, food and several other spends, and they ask 'why should I miss out on the joy of getting home late?' or'have friends party over at my place over the weekend!'

Or tell a young girl that her expensive wedding destination can fund her next few holidays and might better cement the relationship with her spouse compared to a place he may not have any time to enjoy himself. Are the wedding couple likely to trade off the experience of the special day against future gains? The same questions arise between an expensive designer label that “ups” the like quotient on social media vis-à-vis clothes on sale, a second hand vs. a new vehicle, or paying for ambience vs simply awesome food. All tough financial choices for the young. They need counselling that helps them, not persuasive judgmental advice.

Some young earners do save and invest—for a solid future, higher education, a more comfortable life. However, they are not well-informed about their investment choices. They think that a SIP’s returns will fund their next holiday trip to Kosamui or Hawaii or Australia for the next three years because they don’t understand market risk. They don’t know that capital protection is needed for unforeseen expenses they may need to cover.

They buy insurance through ULIPs thinking that it will help them save with discipline without pausing to see that the return is abysmally low. They plan to buy a house thinking it is an appreciating asset, without considering the possibility that they may need to move and therefore draw on the asset.

"Risk comes from not knowing what you're doing." - Warren Buffett

Youth may not require to be conservative, since their age allows them an advantage to take risk, They should be aware that funds available for long term can be considered for risk, irrespective of their earning capacity as long as they understand what they are investing in & what is the risk of the investment.

![]()

Conclusion

They need to know that investments come with specific return, liquidity and risk features and that the choice has to align with their financial goals. They may not be able to take risks even if they have age on their side because they do not have the cushion of accumulated wealth. Risk taking is about ability, not willingness.

Let’s not drown our young with our tales of caution and drive their investments in a context they don’t understand. We need to help them spend, save and invest as per their need after helping them figure out these.

Bibliography

How are Indian youngsters investing, BAJAJ FINSERV | Portfolio Diversification – Why is it important? | What role does Equity play in your Investment Plan? | How does Financial Planning work?