+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

Seeking information is just a click away, however, trusting all that is there online can be a double edged sword

Have you conjured up after you tried to assess your symptoms through online search based on your testing report? Well, all of us have. Subsequently, what followed was a wave of countless assumptions, presumptions, stress, and overthinking and all of this was driven by just one thing- ONLINE INFORMATION.

In the era of internet dominance, obtaining information is just a click away. With the internet being overloaded with information and knowledge, it is challenging to define the extent of information one can consume. While it is not solely about consumption, many users adhere to such online advice that may not yield fruitful results. Hence, trusting all that is there online can be a double edged sword.

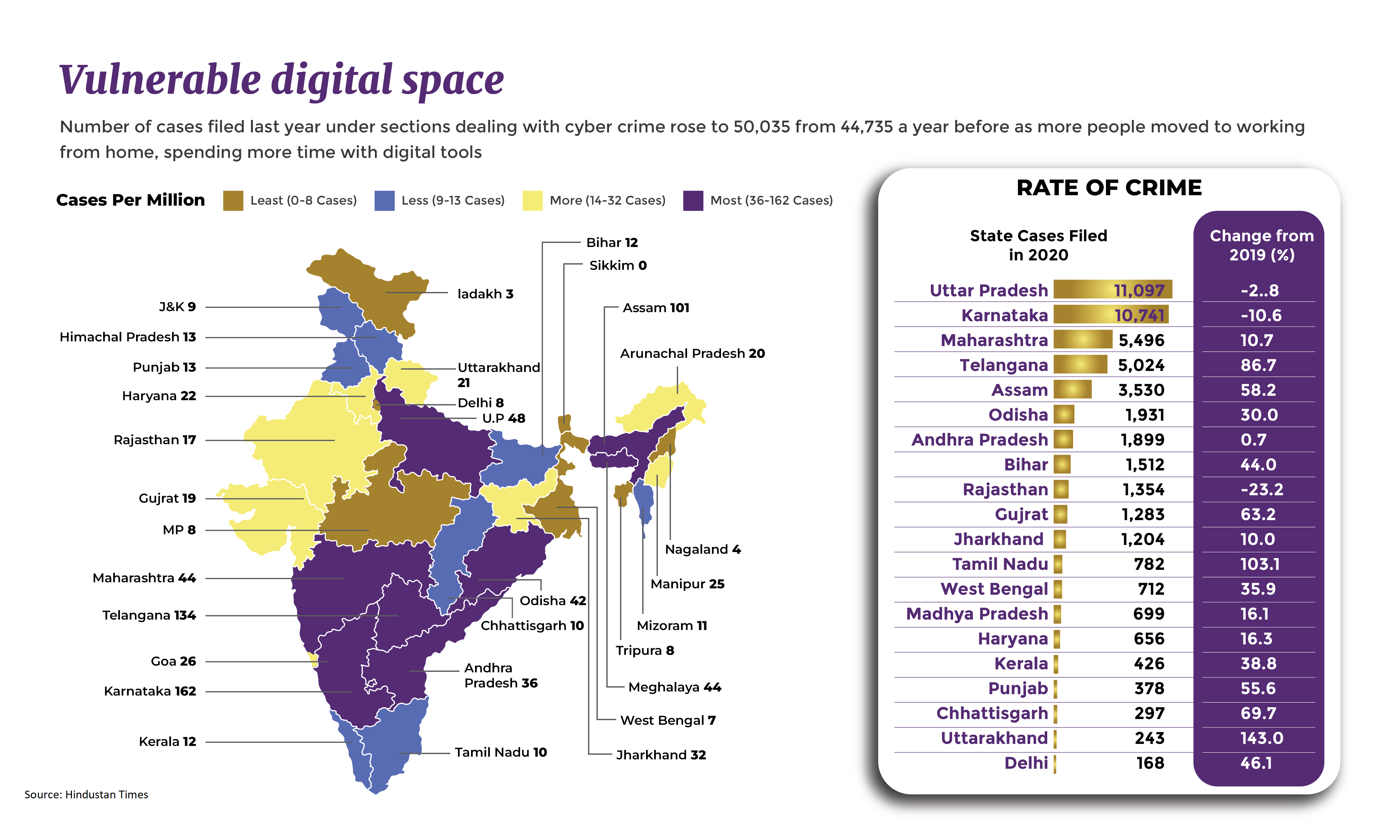

The data is as of 2020 with comparison to 2019. No such data available at present. But, we believe, with the evolving AI tech, machine learning models, it might have perhaps worsened.

In the battle to rank number one on search engines, all sources try hard to rank themselves with the help of content, keywords and ads. Of course, Google has metrics to evaluate everything online, but how effective has it been? In the twisted space of the digital world and online ads, you are consuming knowledge presented to you in a way that drives their agenda and it could be to fraud people.

In the content-driven world, the majority of the content is focused on the larger audience and does not cater to your personal needs or requirements. You must understand the basic needs of your search and implement action accordingly. We are not saying that everything online is dubious, but you have to be careful with what you trust.

In between the unprecedented COVID times, digital consumption spiked and led to an anomalous rise in the creator economy. While many influencers became a beacon of hope for many, others took their chance at content creation. Among the troupe of influencers, the coterie of financial influencers gained acceptance from the larger audience as they brought simplified finance knowledge to the table. But the incandescence of the popularity spreads faster. The growing social influence of these individuals has prompted many others to exploit this platform by generating misleading content aimed at deceiving both the public and investors.

SEBI, the watchdog, had to intervene and address the growing concerns over the links between financial entities and social media influencers. All regulators have been trying their best to filter the noise and bring the most trusted sources in front of you but the treacherous ones find their way out of it. So be careful with everything you read online, especially with financial content. You can always follow trusted brokers, regulators, agencies, or SEBI-registered RIA’s for all the financial information.

Here’s what can you do to make the best of the vast financial information.

Financial profundity is easily accessible. But can you define your goals based on the information found online? In the quest to attract a user base, many sources tend to favour short-term gains over long-term. Indeed, quicker gains do attract people. But it cannot be feasible in the long run if wealth accumulation and good retirement are your aim. Generally, investment and financial planning should be approached with a long-term perspective. Even, if you wish to be on board with short-term gains, check with your advisor and then fly to your goal of earning quickly. However, avoid falling prey to short-term strategies or quick-return investment pieces of advice as they might hinder your long-term plans.