+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

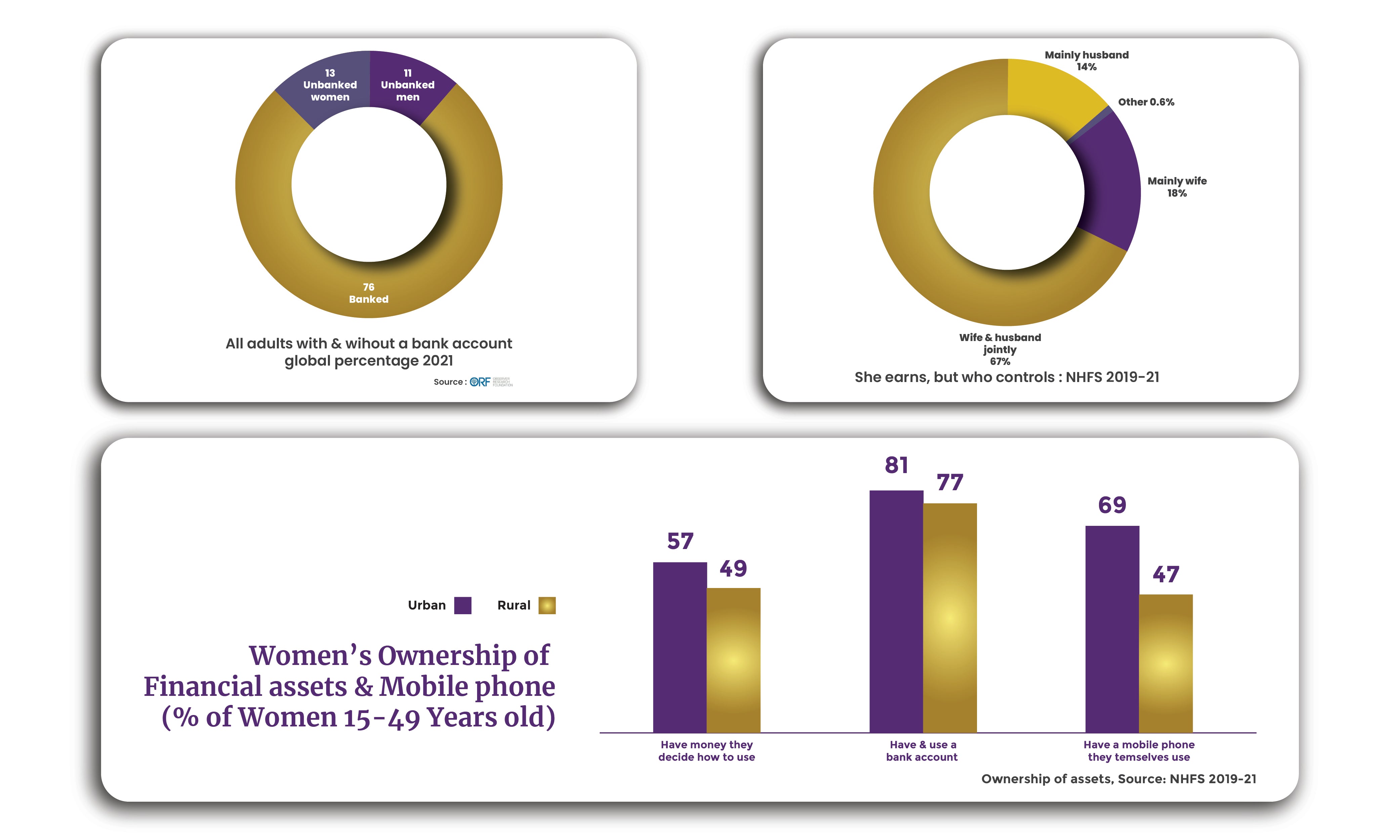

Working women today are rockstars – juggling careers, families, and everything in between. Navigating the labyrinth of credit as a working woman in 2024 can feel like traversing uncharted territory. From juggling career aspirations to managing household responsibilities, the burden of financial obligations can weigh heavily on our shoulders. In this era of empowerment, women face the unique challenges in paying back credit, let’s shed light on a few practical solutions for inclusion and financial independence.

The golden rule of money management – the 50-30-20 rule suggests that you save at least 20% of your income. Spend 50% on your needs such as groceries, utilities, healthcare, housing, etc and not more than 30% towards wants such as restaurants, entertainment etc. Women are very disciplined savers. They are more likely to save regularly in SIPs or Recurring deposits. They are also very prudent in paying timely EMIs and have the lowest default rate.

The journey towards financial empowerment begins with open dialogue. Too often, the struggles of working women in managing credit remain shrouded in silence. It's time to break free from the stigma surrounding financial difficulties and foster a culture of transparency and support.

Sisterhood is Powerful: Form a financial support group with female colleagues or friends. Share

experiences, budgeting strategies, and resources.

Renegotiate, Don't Hesitate: Don't be afraid to negotiate lower interest rates with credit card

companies. You've got this!

Embrace the Side Hustle: Explore freelancing or side gigs to increase your income and accelerate

debt repayment.

Budgeting Bliss: Track your spending ruthlessly. Free budgeting apps can help identify areas to

cut back. Prioritize needs over wants.

Debt Consolidation: Consider consolidating high-interest credit card debt into a lower-interest

loan.

Building and maintaining good credit is crucial for women. It unlocks access to loans for cars, houses, and even starting businesses. At the heart of overcoming the credit conundrum lies the power of strategic planning. Take control of your financial destiny by crafting a comprehensive repayment strategy tailored to your unique circumstances. Start by conducting a thorough assessment of your debts, prioritizing high-interest obligations while ensuring essential expenses are met.

Roadmap to get credit-worthy

Become an Authorized User: Ask a family member with good credit to add you as an authorized user

on their card. This helps build your credit history, but always spend responsibly.

Secured Credit Cards: These require a security deposit, but responsible use gets reported to

credit bureaus, strengthening your credit score.

On-Time Payments: Make all credit card and loan payments on time. Late payments can significantly

damage your credit score.

In the journey towards financial empowerment, working women encounter unique challenges and barriers in managing credit and repaying debts. Knowledge is the cornerstone of financial empowerment. Equip yourself with the tools and resources needed to navigate the nuances of credit management effectively. Attend workshops, seek out online courses, and engage with financial literacy initiatives tailored to the needs of working women.