+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

Estate Planning is one of the important aspects of financial planning. It helps in arranging in advance the management of an individual’s assets in the event of their death. Estate Planning includes eliminating the uncertainties of the probate and also plans for reducing expenses and taxes. While traditionally, a Will is the most commonly used tool for estate planning but there are chances of the Will getting contested before the court due to disputes among legal heirs. Forming a Private Trust Structure is becoming a more sought after option for HNI’s to manage their assets as trusts can be formed with specific goal in mind such as for the benefit of minor children or for children with special needs. Effective planning for the wealth of HNI’s can prevent long and expensive disputes amongst the heirs.

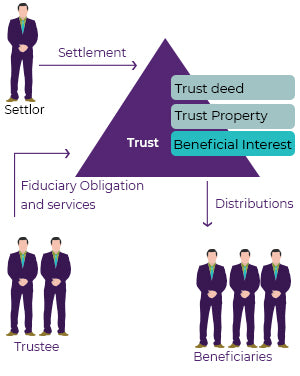

Trust as a concept involves three parties:

A Trust could be either private or public. Private Trusts are created and governed under Indian Trusts Act, 1882. Public Trusts are further divided into charitable and religious trusts.

While we all get overwhelmed by the benefits the trust formation offers, we often ignore the issues it might create in the future for the entitled beneficiaries. Hence, it is very important to first understand few points basis which we can make the decision.

It is advisable to form a trust only if the objective is clear. It is good to create a trust if you wish to safeguard the interests of your aged parents fearing that they may outlive you and there won’t be anyone to take care of their well being, or for minor children or children with special needs. Because there are chances that the siblings/relatives might not fulfill their responsibilities. In such cases, Trust makes sense as the objective is to protect the assets for the individuals who will not be able to handle it on their own. A Public charitable Trust can also be formed if you wish to donate a part of your assets towards a charitable cause and don’t wish your family to intervene.

The trustee may be a beneficiary, a family member, a relative, or even a professional trustee. Author of the Trust can also be one of the Trustees. Proper care should be taken while appointing trustees during formation of the Trust and successor trustees. In some trusts like Discretionary Trusts, Trustees have full right to choose the beneficiaries and also the extent to which the beneficiary can benefit. One can also opt for Corporate Trustees as professional managers for the management of the Trust’s assets. Since Professional Trustee is not a person but a Corporate which will continue to be part of the Trust and is not affected by retirement, death, illness and hence cannot impact the trust structure. One should also understand that Corporate Trustees come at a certain recurring costs and the asset base should be big enough to manage the expenses of hiring a Corporate Trustee.

It is very important to understand for the Settler that once he moves his assets to a Trust, he may at some time, be involving third parties to control the assets which were earlier controlled only by him/her. For those who wish to retain control over the assets, Trust formation has to be done with careful planning with proper understanding of the legal formalities of the Trust.

It makes perfect sense to have Trust if the assets in account are sizeable and are required to be divided to many persons and causes. For e.g. Mr. Z, promotor of a renowned listed Company settled his shares in revocable private trusts and a public charitable trusts. This way, he can also contribute towards his philanthropic needs and also ensure control over his shareholding in the Private Trust and the shares will be passed on to the intended beneficiaries after his demise.

Even though Trust formation provides benefits on the taxation front, it might not be worth the effort if the asset value is nominal. Sometimes, it is also good to trust the intelligence of your children as they grow older to be prudent, careful and intelligent with their legacy or whoever may be the beneficiaries and have a well-drafted Will instead of forming a Trust for their benefit.