+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

April '2023

Positive ![]() Negative

Negative ![]() Neutral

Neutral ![]()

| PARAMETERS, EVENTS | IMPACT | REASON |

| Inflation (CPI - India) | Inflation increased at 7.44% in July, 2023 from 4.87% reached in June, 2023. | |

| Brent Crude | Brent crude price decreased by -1.58% In Aug, 2023 | |

| Currency USD/INR | Rupee depreciated by 0.56 % in Aug, 2023 | |

| GDP | GDP growth of India is reported at 13.5% for Q1FY23, 3.8% absolute growth from pre-pandemic level. | |

| FII Inflows | FIIs were Net-sellers of Indian equities to the tune of Rs. 12,262 Cr in Aug, 2023 | |

| DII Inflows | DIIs poured Rs. 25,017 Cr worth of Indian equities in Aug, 2023. | |

| G-Sec Yield | Yield slightly decreased to 7.16% from 7.17% in Aug, 2023 end. | |

| Tax Collection | Record GST collection of Rs. 1.48 Lakh Cr in July, 2022. | |

| Global - Inflation | US inflation has slightly increased at 3.2% in July 2023 from 3% in June 2023 |

| EQUITY MARKETS | IMPACT | REASON |

| Q4FY22 Earnings session | Earning upgraded for 42% of Nifty 50 companies whereas 26% companies earning downgraded and remaining 32% remains in-line ( as per Motilal Oswal research report) | |

| Valuations-PE | It stood at 21.97 times in Aug-2023, -28.23% below Oct, 2021 peak. | |

| Valuations-PB | It stood at 4.4 times in Aug-2023, -5.23% below Oct, 2021 peak. | |

| Valuations - Market cap to GDP ratio | Current market cap to GDP ratio is at 106%, above its long-term average of 80% but below the peak valuation of 113% in FY 2022. |

High Risk ![]() Moderate Risk

Moderate Risk ![]() Low

Risk

Low

Risk ![]()

| RISK FOR EQUITIES | LEVEL OF RISK |

| Rising Oil prices & Commodity inflation | |

| Geopolitical tension | |

| FII's being a Net-Seller | |

| US FED - Tightening | |

| US FED - Interest rate hike | |

| RBI-Sucking out liquidity | |

| Current Valuations |

EVENTS, NATURE OF IMPACT & ANALYSIS

Booming India’s GDP growth

India’s GDP growth booms to the four-quarter high of 7.8 % in Q1FY24.

IMPACT: POSITIVE![]()

Remarks: In accordance with the data

released by the National Statistical Office (NSO) on 31st Aug 2023, India’s GDP has grown at 7.8% in

Q1, which is the highest amongst the last four quarters.

This latest quarterly growth number is perceptibly in line with expectations. In the

meantime, the RBI had estimated a growth rate of 8%.

The Central and State Govt. CapEx, an upswing in agriculture, and robust performance by the service sector are the key drivers.

Presently, India stands out to be the fastest-growing major economy as China’s GDP growth in the April-June quarter was 6.3%.

Nifty 50 Cos. posted 32% earnings growth in Q1FY24 !

Stellar results from Nifty 50 companies in the first quarter of FY2024 – BFSIs & Autos are the front runner.

IMPACT: POSITIVE![]()

Remarks: After a solid 22% earnings CAGR over FY20-23, Nifty Cos. opened FY24 with a 32% earnings growth in the first quarter of FY2023-24. It has been largely in line with consensus estimates. However, there are notable earning upgrades in Tata Motors, JSW Steel, Bharti Airtel, SBI, and Kotak Mahindra Bank.

On aggregate level, Nifty 50 Cos. posted EBITDA and PAT growth of 22% and 32% YoY respectively as against the expectation of 18% and 25% growth. The market had already factored in a 25% PAT growth for Nifty valuation and is trading at 18x PE on 1-Year forward basis. With the results surpassing expectations, we are of the view that the valuations are healthy and would sustain at this level for next couple of quarteRs. In addition, downside risk is comparatively lesser from valuation perspective – but there is always a room for unknown risks which we need to be cautious about.

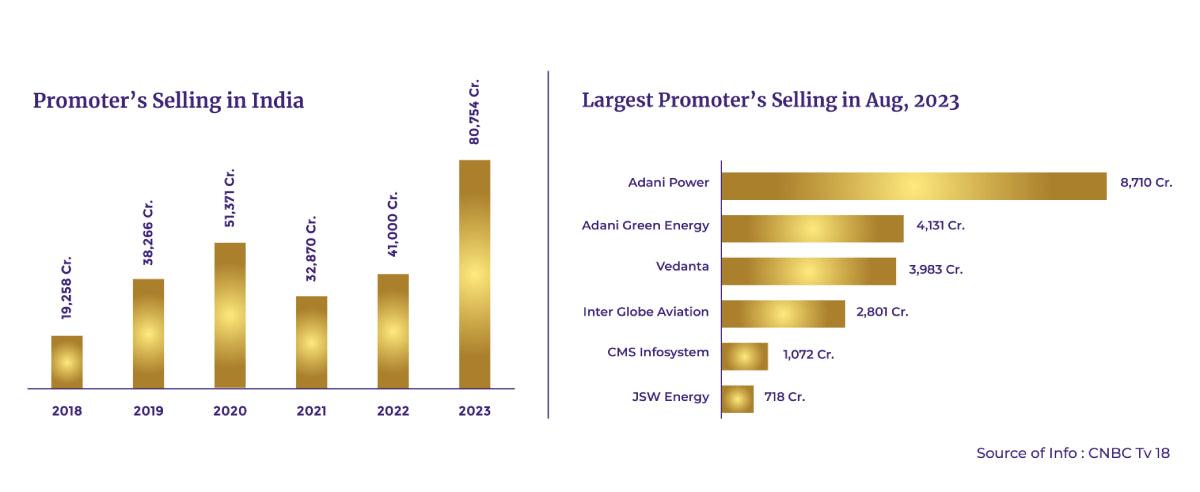

Promoter Sell-off at All-time high:

Promoters are offloading their equity - value has reached nearly Rs81,000 crore so far this year.

IMPACT: NEGATIVE![]()

Remarks:

We have witnessed an unprecedented surge in promoter sell-offs this year, totaling nearly Rs 81,000 crore so far. Notably, a significant portion of these exits has come from mid-cap and small-cap companies.

Indian promoters have historically demonstrated a knack for market timing. They tend to acquire shares during a market downtrend and divest during euphoric markets. Currently, with the market's high valuation being primarily driven by domestic liquidity, Indian promoters are seizing the opportunity to cash in. This trend is likely to exert a downward pressure on respective stock prices in the near future.

A check on the Monsoon again:

All-time highest average temperature over a century for the month of August in India.

IMPACT: NEGATIVE![]()

Remarks:

In our previous Health of Wealth report, we noted that the RBI did not anticipate any significant impact on inflation from the irregular monsoon, as there were still two months remaining in the monsoon season. However, recent reports from the India Meteorological Department (IMD) have revealed that this year, India has experienced the highest average temperature for the month of August in over a century, primarily due to a reduced amount of rainfall.

The IMD attributes this high temperature to rain deficiency and weak monsoon conditions. Approximately 36% of India's districts, or 263 out of 717, have received deficient or significantly deficient rainfall, with deficits exceeding 20%. The cumulative rainfall for the season has fallen to a 5% deficit, falling below the normal range of ±4% of the Long Period Average (LPA). Since 2015, India has consistently experienced a decent amount of rainfall each year. However, this year, there is a noticeable shortfall in precipitation.

While weather experts suggest that the monsoon is expected to normalize with September's rainfall compensating for the deficit, failure to do so could lead to inflationary pressures. Additionally, with parliamentary elections approaching, the government faces a challenging task in managing inflation while also addressing the needs of farmers by providing a reasonable Minimum Support Price (MSP).

Inconvenient Developments for Insurance Buyers:

The central govt. has issued a guideline regarding taxation of endowment insurance policies, following the union budget announcement in Feb-2023.

IMPACT: NEGATIVE![]()

Remarks:

The Central Govt. has recently provided a comprehensive guideline pertaining to the taxation of Endowment Insurance Policies, building upon the initial announcement made in the February 2023 Union Budget.

These guidelines outline the specific tax implications and regulations surrounding endowment policies. As we had mentioned earlier, this move from the government aims to ensure that individuals utilize life insurance policies primarily for risk mitigation and providing financial security to their family and not solely as a tax-saving investment tool.

What you should do. And should not.

![]()

Remain invested in equity in this current volatile market scenario.

![]()

Continue your

investment

systematically in the way of SIP & STP.

![]()

There are opportunities in long-term debt, lock the fund for regular inflow.

![]()

Consider creating cash from mid & small cap equity for short-term requirements.

![]()

Conclusion

Please remember investing is mostly backing quality businesses run by quality managements that offer a runway for strong cash flow growth, earnings potential, and long-term prospects. Buying them at a “reasonable” price with an eye on the returns is important. Stay invested, stay disciplined and secure your returns. We have prepared a sound long term holistic financial plan for you based on your risk profile, defined your financial goals along with you… did an asset allocation (with contingency plans built in) with you. We believe we are in the best objective position to help navigate the vagaries of the market.

Standard Warning & Disclaimer: