'Don’t try to predict the future, Prepare for it. Predicting rains doesn’t count, Building the ark does'

Warren Buffett wrote in Berkshire’s Year 2001 Annual report, and he admitted that he had expected certain risks but he hadn’t acted to mitigate them

If we remember year 2001, it was one of the most euphoric equity markets globally led by Tech stocks. In India, Infosys and Wipro were traded at 200, 300 PE and Interestingly. It took 20 years for Wipro to reach the peak which it did in 2001.

In this context, now SENSEX is hovering around 60000 levels and whether we are in such a euphoric stage right now and everyone is trying to understand and trying to prepare in case of any major correction from here onwards.

While trying to find the answer for this puzzle, first let us understand what caused this massive rally in Indian equities for past 19 months.

Broadly, these three aspects drove the equities to the record high and let us try to understand how the Massive Liquidity aspect impacted the market.

Massive Liquidity

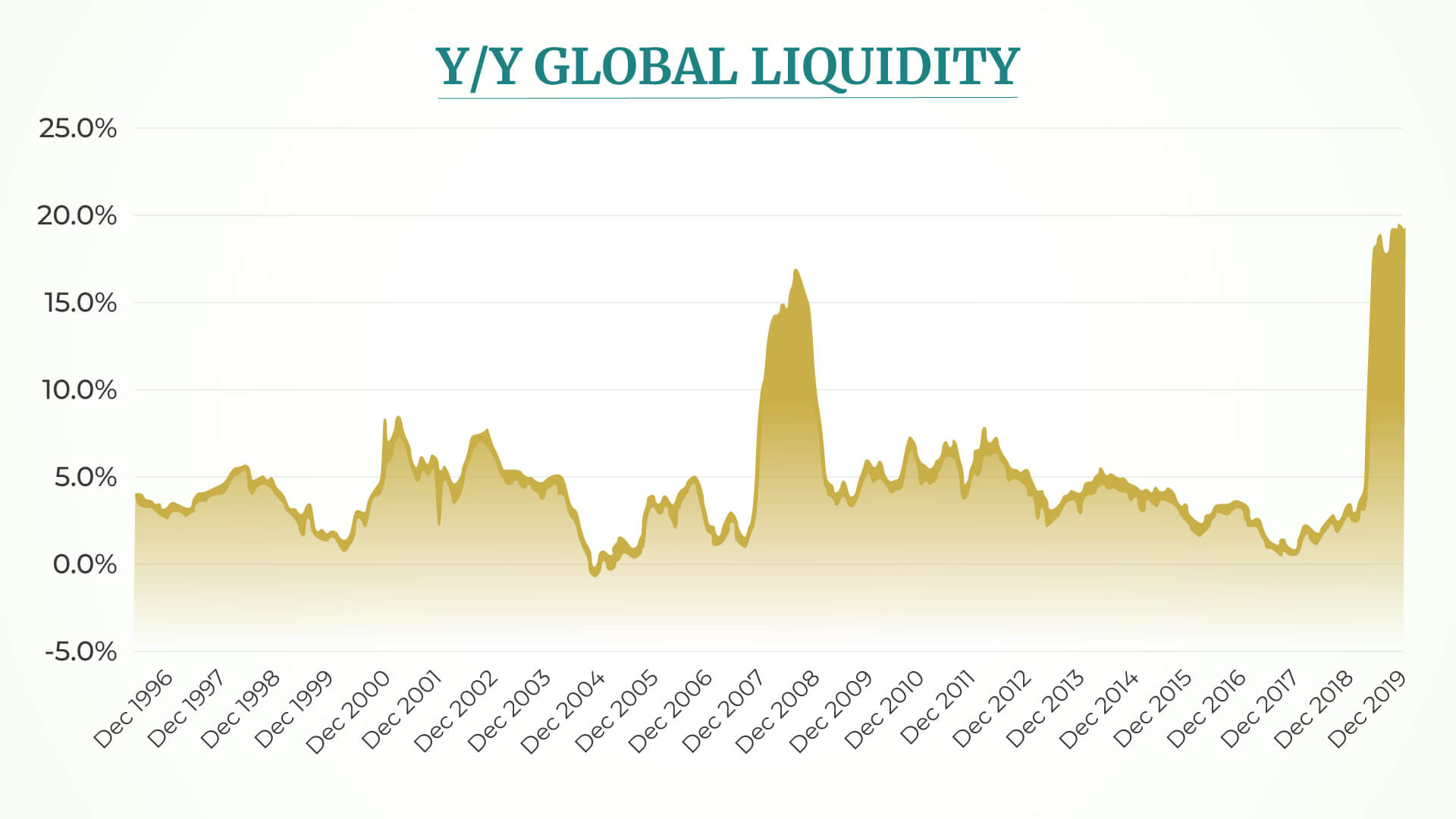

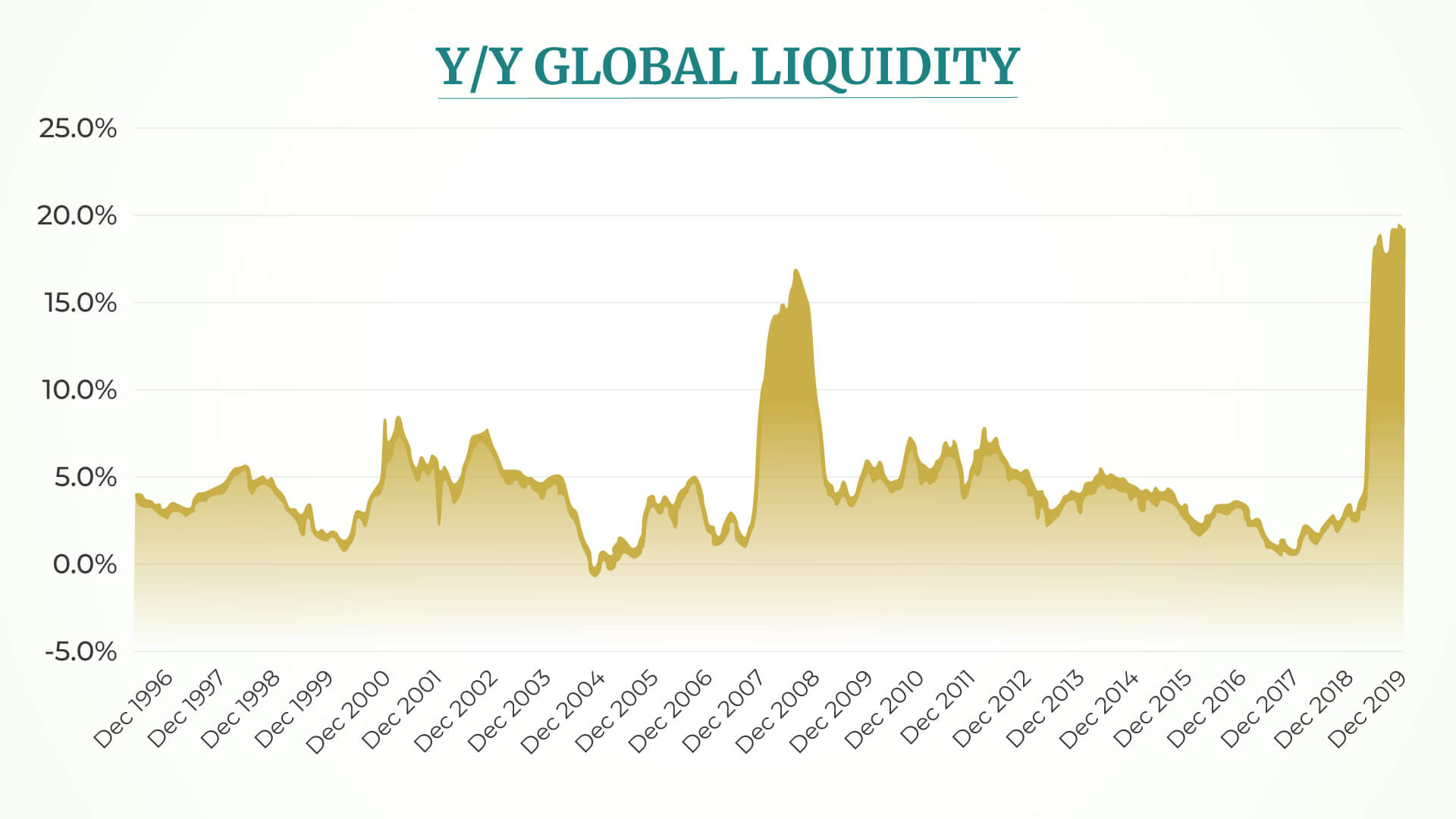

Undoubtedly, liquidity is the primary reason and advanced economies of the world injected almost $10 trillion into the system through “cash handout to public, infrastructure spending etc”. US FED is still injecting $120 billion liquidity every month. Usually, this massive money has to be invested somewhere and the expected return from such investments need to be reasonable. Since the interest rates have bottomed out, the returns from debt asset class is minuscule and hence, this massive money in the system is chasing riskier asset such as equity, cryptos etc.

Massive Liquidity & its impact in only Indian Equities

- The PE fund TPG announced that it will invest $1.6 billion into electric vehicle division of Tata motors at $9 billion valuation. However, for the matter of fact, Tata motors has sold till now around 10000 EVs in India. Due to huge domestic auto market in India, TPG is ready to invest in Tata Motors EV subsidiary at $9 billion valuations!

- Various PE funds have invested in unlisted subsidiaries of following few pharma companies and also few of listed Pharma companies also since the potential is high.

- Pharma division of Piramal enterprises – PE Fund Carlyl invested in this company.

- 'Stelis' – Bio tech division of Strides Pharma & Science – PE fund called TPG Growth fund owns significant stake in Stelis and it is unlisted subsidiary of Strides Pharma focusing on Bio Tech.

- JB Chemicals & Pharma (Majority holdings is with PE fund i.e Tau Investment holdings)

- Sequent Scientific – PE fund called Ca Harbour investments invested in Sequent and this deal happened in Q2FY21 and Sequent is a listed animal pharma company.

- The PE fund TPG announced that it will invest $1.6 billion into electric vehicle division of Tata motors at $9 billion valuation. However, for the matter of fact, Tata motors has sold till now around 10000 EVs in India. Due to huge domestic auto market in India, TPG is ready to invest in Tata Motors EV subsidiary at $9 billion valuations!

- Various PE funds have invested in unlisted subsidiaries of following few pharma companies and also few of listed Pharma companies also since the potential is high.

- Pharma division of Piramal enterprises – PE Fund Carlyl invested in this company.

- 'Stelis' – Bio tech division of Strides Pharma & Science – PE fund called TPG Growth fund owns significant stake in Stelis and it is unlisted subsidiary of Strides Pharma focusing on Bio Tech.

- JB Chemicals & Pharma (Majority holdings is with PE fund i.e Tau Investment holdings)

- Sequent Scientific – PE fund called Ca Harbour investments invested in Sequent and this deal happened in Q2FY21 and Sequent is a listed animal pharma company.

- Apart from this, Global tech giants i.e Facebook, Google etc invested in Jio Platforms which is unlisted subsidiary of Reliance Industries.

- Similarly, various funds have invested in Reliance Retail which is also unlisted subsidiary of Reliance. Investments by PE funds as well as global tech giants are the primary reason for rerating of Reliance Industries in FY21 when its core business “Oil” was struggling.

- These are few of the examples about the impact of massive liquidity flows into Indian equities.

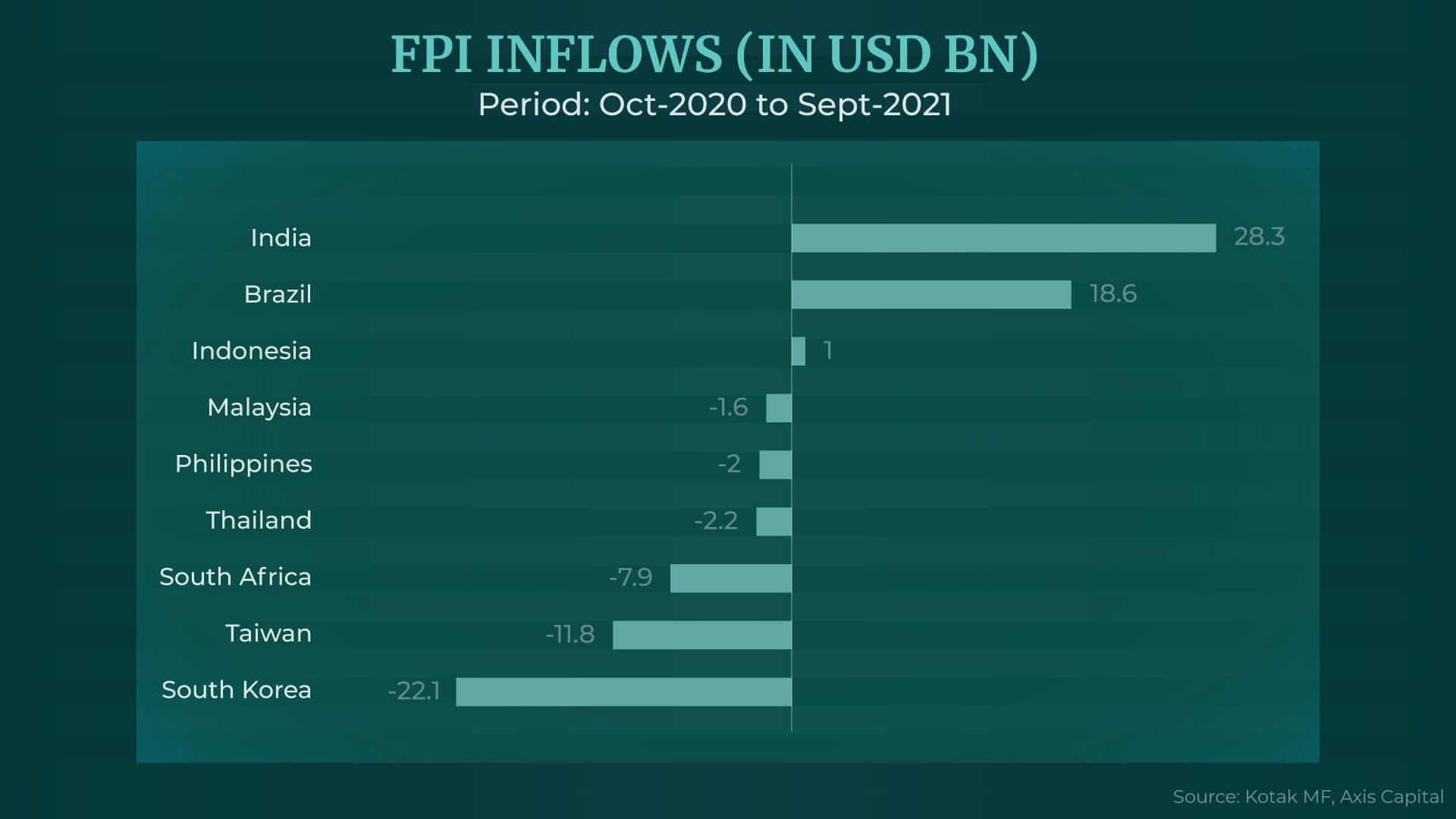

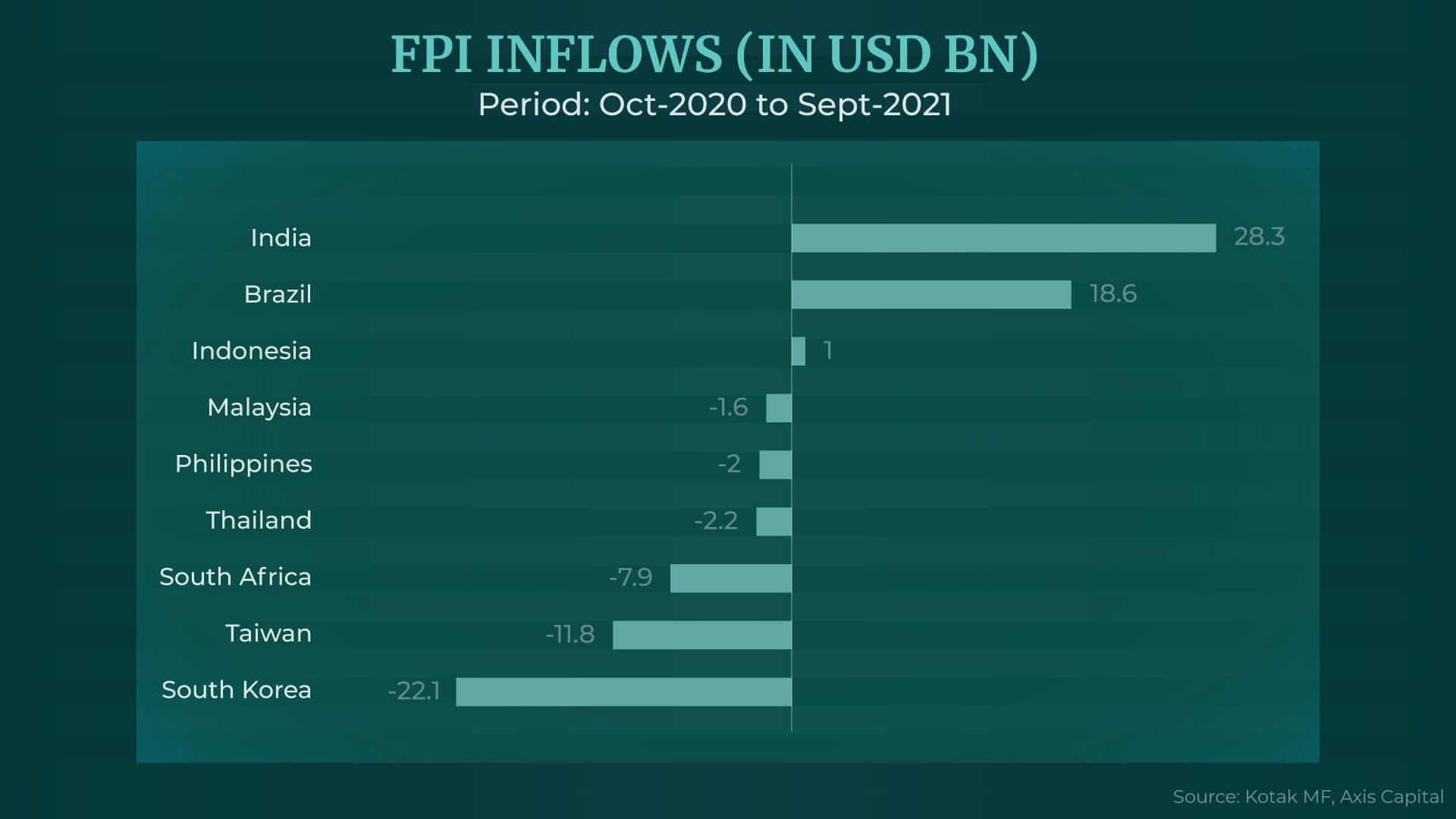

- Apart from this, FIIs have poured ₹2.74 lakh Cr in Indian equities in FY21 and however, they are net-sellers to the tune of ₹10700 Cr in this FY22 till now. However, when we compare FIIs inflows in FY21 & FII outflows in FY22, the outflows are minuscule. According to this two data points about FIIs, it is evident that they are not aggressive sellers right now and whatever they sell, the same is getting absorbed by DIIs as well as Retail investors.

- Among the emerging markets, India got massive inflows from FIIs to the tune of $28 billion in past 1 year.

- Apart from this, Global tech giants i.e Facebook, Google etc invested in Jio Platforms which is unlisted subsidiary of Reliance Industries.

- Similarly, various funds have invested in Reliance Retail which is also unlisted subsidiary of Reliance. Investments by PE funds as well as global tech giants are the primary reason for rerating of Reliance Industries in FY21 when its core business “Oil” was struggling.

- These are few of the examples about the impact of massive liquidity flows into Indian equities.

- Apart from this, FIIs have poured ₹2.74 lakh Cr in Indian equities in FY21 and however, they are net-sellers to the tune of ₹10700 Cr in this FY22 till now. However, when we compare FIIs inflows in FY21 & FII outflows in FY22, the outflows are minuscule. According to this two data points about FIIs, it is evident that they are not aggressive sellers right now and whatever they sell, the same is getting absorbed by DIIs as well as Retail investors.

- Among the emerging markets, India got massive inflows from FIIs to the tune of $28 billion in past 1 year.

All of the above points display 'the significance of massive liquidity and subsequent bull markets which is being prevalent now'.

Now that we have seen the causes for current uptrends and now, let us understand the concerns around the sustainability of current levels of markets and further uptrend.

We urge you to have conversations with financial advisors who have seen and navigated these cyclical rises and falls. They are in the best objective position to help you understand and mitigate the risks of letting emotion get the better of you.

We urge you to have conversations with financial advisors who have seen and navigated these cyclical rises and falls. They are in the best objective position to help you understand and mitigate the risks of letting emotion get the better of you.

Reach out to us

We can help you understand how to maximise your investment goals or leave a comment below on your thoughts.

Bibliography

Global Liquidity, For Now, is Flooding Emerging Markets, THE EMERGING MARKETS INVESTOR