+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

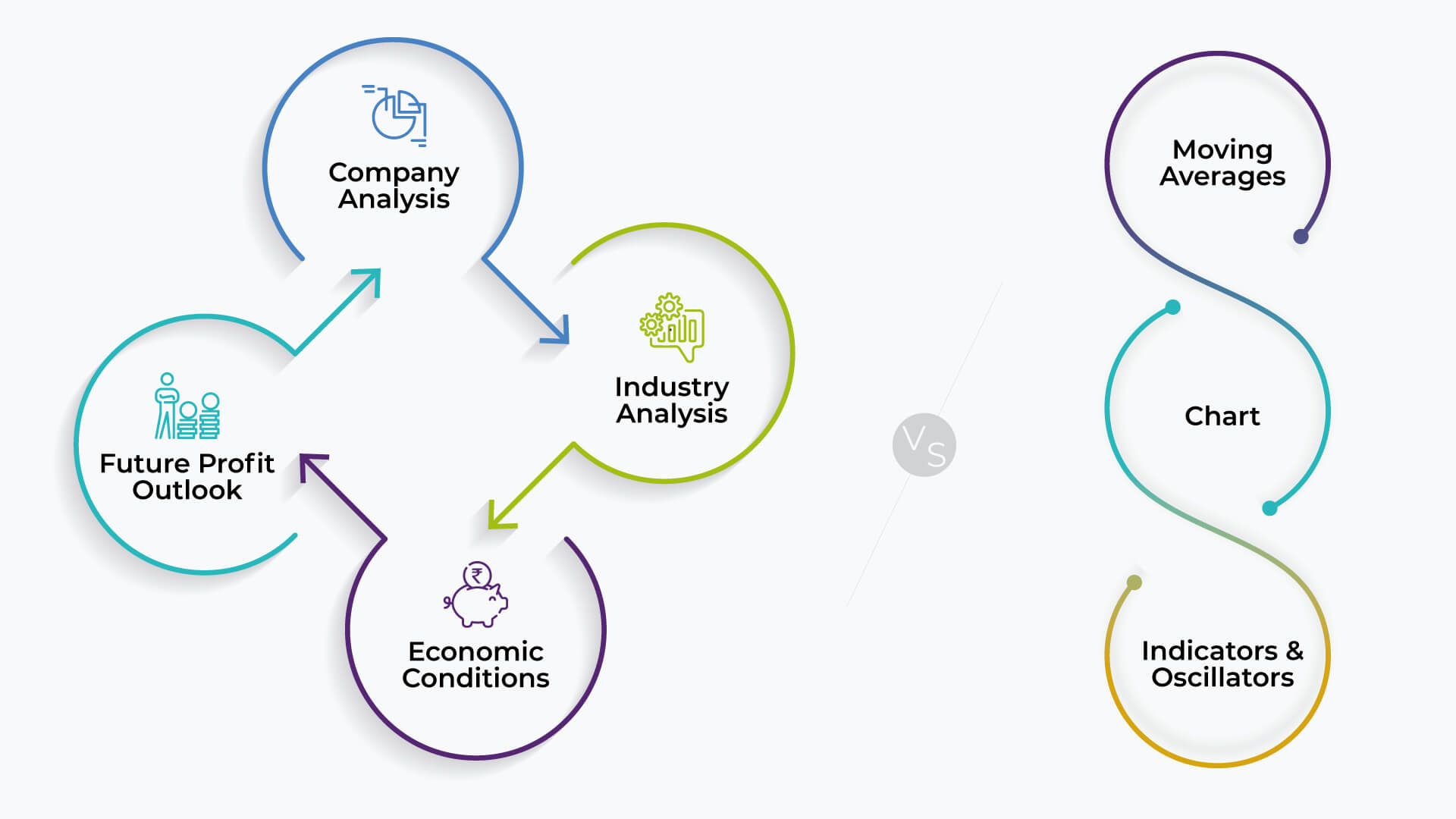

Many clients have asked me what we focus on when we advise them on the investment style best suited to them. Fundamental and technical analysis are two major schools of thought when it comes to approaching the markets yet are at opposite ends of the spectrum.

A Fundamental analyst evaluates stocks by attempting to measure their intrinsic value. They study everything from the overall economy and industry conditions to the financial strength and management of individual companies - Earnings, expenses, assets, and liabilities all come under scrutiny by fundamental analysts.

A Technical analysis differs from fundamental analysis, in that traders attempt to identify opportunities by looking at statistical trends, such as movements in a stock's price and volume. The core assumption is that all known fundamentals are factored into price, thus there is no need to pay close attention to them. Technical analysts do not attempt to measure a security's intrinsic value. Instead, they use stock charts to identify patterns and trends that suggest what a stock will do in the future.

A Fundamental analyst evaluates stocks by attempting to measure their intrinsic value. They study everything from the overall economy and industry conditions to the financial strength and management of individual companies - Earnings, expenses, assets, and liabilities all come under scrutiny by fundamental analysts.

A Technical analysis differs from fundamental analysis, in that traders attempt to identify opportunities by looking at statistical trends, such as movements in a stock's price and volume. The core assumption is that all known fundamentals are factored into price, thus there is no need to pay close attention to them. Technical analysts do not attempt to measure a security's intrinsic value. Instead, they use stock charts to identify patterns and trends that suggest what a stock will do in the future.

At Sinhasi we advocate a combination of both fundamental aspects and technical (price-volume action) factors to build clients portfolio - the CANSLIM approach being a key one. Implemented initially by Mr. William O’ Neil, the CAN SLIM approach has been followed and deployed successfully by one of our key partners in India - Girik Capital.

The CAN SLIM strategy followed by Girik combines fundamental factors of the stocks along with the “supply-demand” scenario prevalent in stock exchanges. It screens the “Universe of Stocks” and defines how to pick winners.

Technical factors - Relative strength of the stock as well as industry / sector compared to market is used to identify the strong stocks in every situation.

Once the universe is defined, a due diligence is done on fundamental factors, corporate governance, balance sheet, acceleration in earnings, valuation parameters, leadership in respective segment / product / service wise etc.

Once the leadership of the stocks is established as per fundamental aspects, they use the technicals to identify the right buy-point - price-volume action is used.

The position size is finalised basis fundamental as well as technical aspects.

Once a stock is bought, weekly reviews are done on both the fundamental factors and the technical factors to manage the risk efficiently without any bias.

A Sell call is taken when there is either a euphoric move in the stock - its price gets extended from moving averages or in case of a deterioration in the fundamentals, a management change, or any technical weakness.

Earnings growth is predominantly monitored for NIFTY stocks since they are widely tracked. Earnings forecast / management guidance are not available for many Small & Mid cap companies.

At Sinhasi we advocate a combination of both fundamental aspects and technical (price-volume action) factors to build clients portfolio - the CANSLIM approach being a key one. Implemented initially by Mr. William O’ Neil, the CAN SLIM approach has been followed and deployed successfully by one of our key partners in India - Girik Capital.

The CAN SLIM strategy followed by Girik combines fundamental factors of the stocks along with the “supply-demand” scenario prevalent in stock exchanges. It screens the “Universe of Stocks” and defines how to pick winners.

Technical factors - Relative strength of the stock as well as industry / sector compared to market is used to identify the strong stocks in every situation.

Once the universe is defined, a due diligence is done on fundamental factors, corporate governance, balance sheet, acceleration in earnings, valuation parameters, leadership in respective segment / product / service wise etc.

Once the leadership of the stocks is established as per fundamental aspects, they use the technicals to identify the right buy-point - price-volume action is used.

The position size is finalised basis fundamental as well as technical aspects.

Once a stock is bought, weekly reviews are done on both the fundamental factors and the technical factors to manage the risk efficiently without any bias.

A Sell call is taken when there is either a euphoric move in the stock - its price gets extended from moving averages or in case of a deterioration in the fundamentals, a management change, or any technical weakness.

Earnings growth is predominantly monitored for NIFTY stocks since they are widely tracked. Earnings forecast / management guidance are not available for many Small & Mid cap companies.

Earnings deceleration is going to prevail in commodity sectors i.e., Steel & Aluminium and margin contraction in FMCG. Many of the companies posted margin compression due to raw material price hike. The same is not applicable to banking & financial services. In FY22-23, earnings growth is going to be driven by Banks, Reliance, NBFCs and Autos.

Charandeep Singh

Co-Founder & Fund Manager,

Girik Capital

Using The CANSLIM Approach

Reliance Industries

ICICI Bank

Blue-Dart

![]()

Conclusion:

Please remember investing is mostly backing quality businesses run by quality managements that offer a runway for strong cash flow growth, earnings potential, and long-term prospects. Buying them at a “reasonable” price with an eye on the returns is important. Stay invested, stay disciplined and secure your returns.

Most good advisors prepare a sound long term holistic financial plan for you based on your risk profile, define your financial goals along with you… do an asset allocation (with contingency plans built in) with you. They are in the best objective position to help you navigate the markets. Reach out to us at XXXXXXX to understand how we can help you maximize your investment goals or leave a comment below on your thoughts.

We urge you to have conversations with financial advisors who have seen and navigated these cyclical rises and falls. They are in the best objective position to help you understand and mitigate the risks of letting emotion get the better of you.

We urge you to have conversations with financial advisors who have seen and navigated these cyclical rises and falls. They are in the best objective position to help you understand and mitigate the risks of letting emotion get the better of you.