+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

February 2024

Positive ![]() Negative

Negative ![]() Neutral

Neutral ![]()

| PARAMETERS, EVENTS | IMPACT | REASON |

| Inflation (CPI - India) | Inflation decreased to 5.10% in Jan, 2024 from 5.69 % reached in Dec 2023. | |

| Brent Crude | Brent crude price increased by 2.22% In Feb 2024 | |

| Currency USD/INR | Rupee appreciated by 0.23 % in Feb, 2024 | |

| FII Inflows | FIIs were Net-buyers of Indian equities to the tune of Rs.1,539 Cr in Feb, 2024 | |

| DII Inflows | DIIs poured Rs.25,379 Cr worth of Indian equities in Feb, 2024 | |

| G-Sec Yield | Yield slightly decreased to 7.078% from 7.14% in Feb, 2024 end. | |

| Global - Inflation | US inflation has slightly decreased at 3.1% in Jan 2024 from 3.4% in Dec 2023 |

| EQUITY MARKETS | IMPACT | REASON |

| Valuations-PE | It stood at 22.7 times in Feb 2024, -24.1% below Oct, 2021 peak. | |

| Valuations-PB | It stood at 3.85 times in Feb 2024, -20.26% below Oct, 2021 peak. | |

| Valuations - Market cap to GDP ratio | Marketcap to GDP is at all-time high in CY closing basis, 131% for CY 2023. |

High Risk ![]() Moderate Risk

Moderate Risk ![]() Low

Risk

Low

Risk ![]()

| RISK FOR EQUITIES | LEVEL OF RISK |

| Rising Oil prices & Commodity inflation | |

| Geopolitical tension | |

| FII's being a Net-Seller | |

| US FED - Tightening | |

| US FED - Interest rate hike | |

| RBI-Sucking out liquidity | |

| Current Valuations |

EVENTS, NATURE OF IMPACT & ANALYSIS

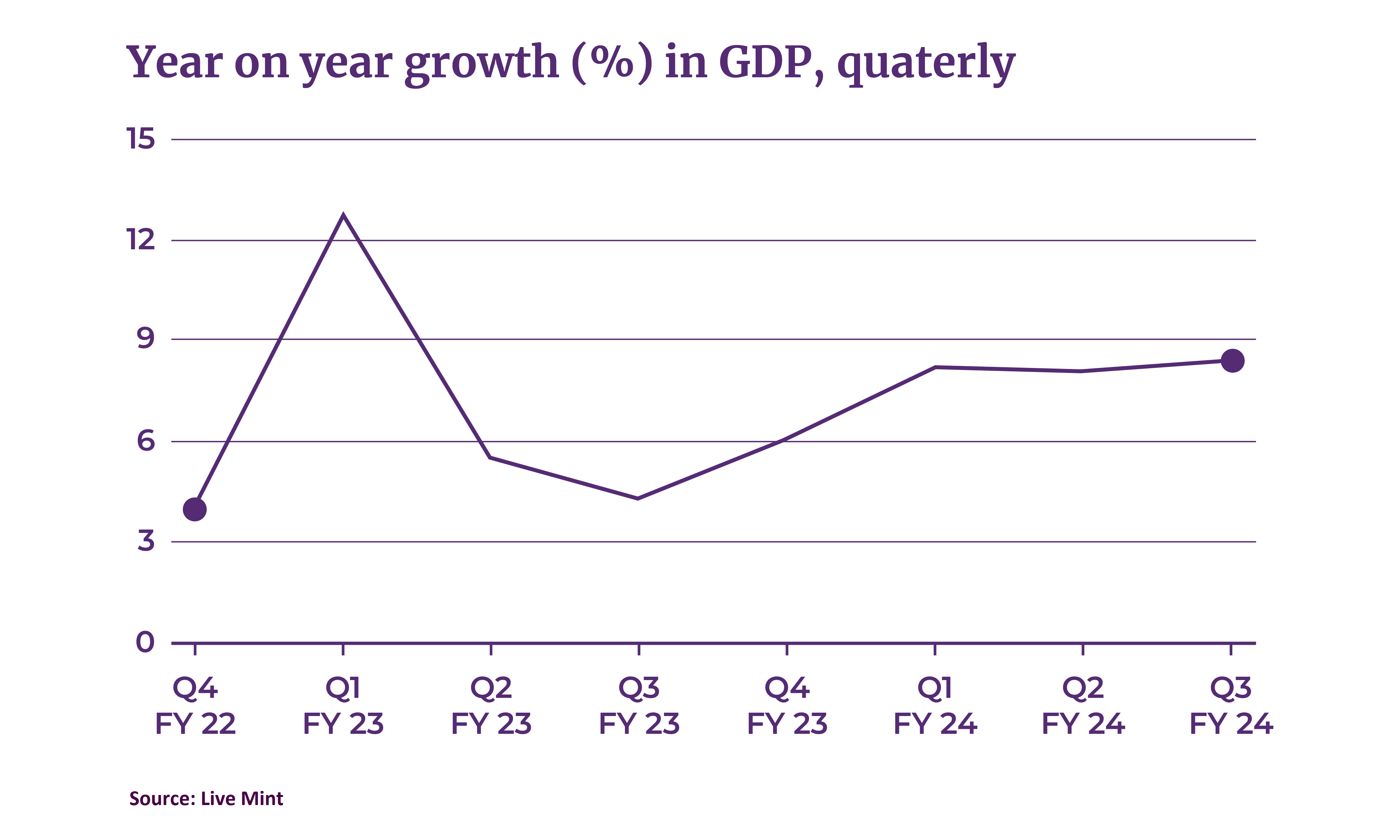

India’s GDP grew strongly by 8.4% during the Oct-Dec quarter of FY24.

IMPACT: POSITIVE![]()

Per the data released by the National Statistical Office (NSO) on 29th Feb 2024, India’s GDP has grown by 8.4% in Q3 FY24.

This latest quarterly growth number has surpassed expectations. Meanwhile, RBI had estimated a growth rate of 6.5%. Notable growth of 11.6% in the manufacturing sector and 9.5% in the construction sector are the key drivers.

Previously in this current fiscal year, the Indian Economy had expanded at 7.8% in the first quarter and 7.6% in the second quarter. Government policies & reforms, external factors and sectoral performance can be the reasons for growth variations amongst the quarters.

However, the Q3 GDP figures showcase India’s vitality amidst global uncertainties and more importantly, India continues to be the fastest-growing major economy.

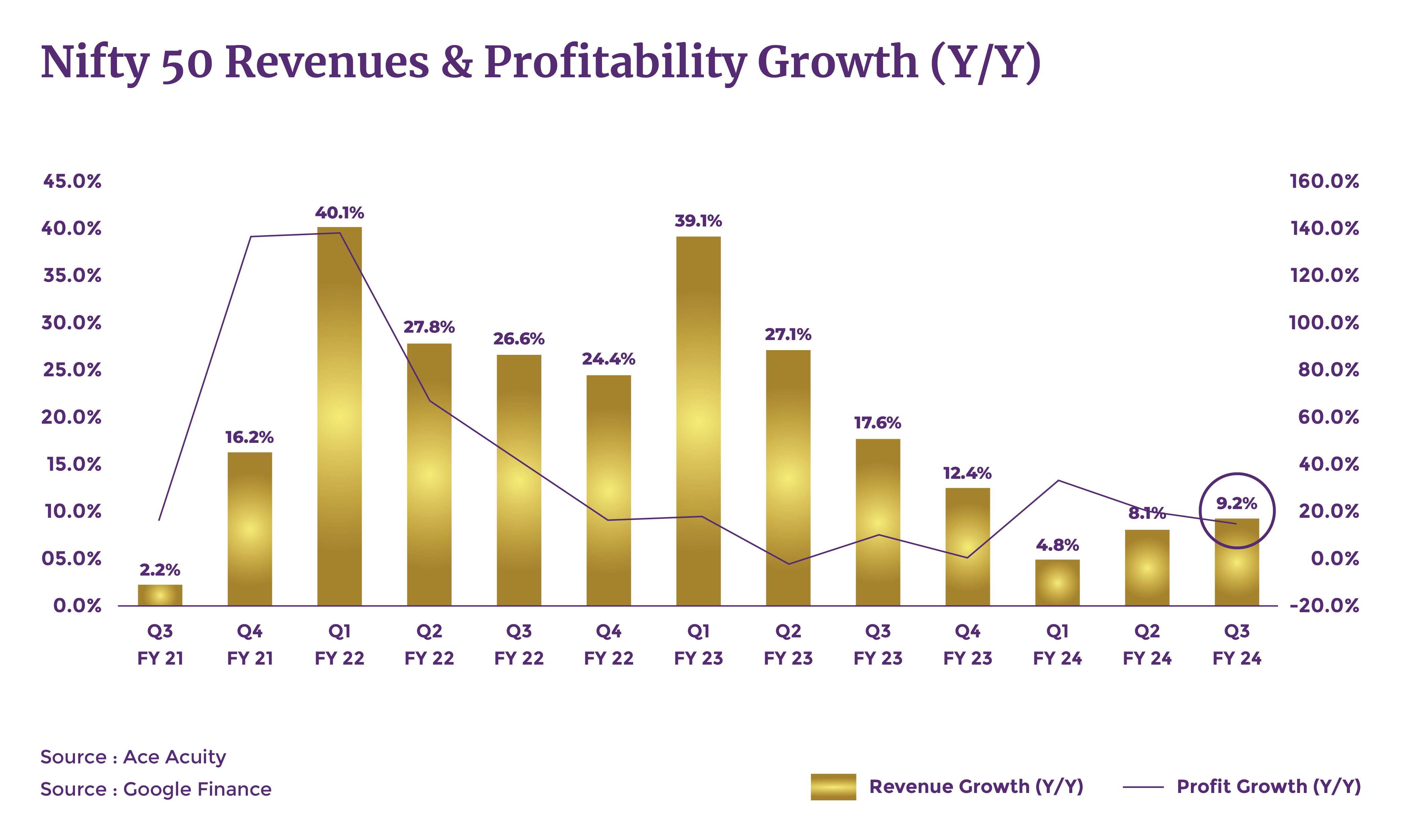

Nifty 50 Cos posted a solid PAT growth of 17% in Q3 FY24.

IMPACT: POSITIVE![]()

The Nifty 50 has outperformed its forecasts with a 17% (YoY) PAT growth (as against the estimated +10%. 5 Nifty companies – Tata Motors, HDFC Bank, Tata Steel, ICICI Bank, and JSW Steel – contributed 56 per cent of the incremental YoY accretion in earnings.

Domestic cyclical sectors such as Auto & Financials along with global cyclicals i.e. metals & gas being the key drivers. BFSI reported a healthy 22% YoY growth in earnings, while the automobile sector registered a 60% growth. The metal sector saw a significant increase in profits due to lower cost pressure.

Overall, Q3 FY24 corporate earnings ended on expected lines. However, some sectors are still facing challenges, like IT, with overall earnings declining for the first time in 26 quarters.

Source: Economic Times, Live Mint, MOFSL Report

Till Feb 10th of 2024, the direct tax collection stands at Rs 15.60 lakh crore.

IMPACT: POSITIVE![]()

Direct tax collection, net of refunds, till February 10 of FY24 stands at Rs 15.60 lakh crore, a growth of 20% year-on-year. It is 80% of the revised Budget Estimates for the full financial year.

The gross revenue collections for Corporate Income Tax (CIT) and Personal Income Tax (PIT) have seen steady growth, as per the CBDT data. The net growth rate for the Corporate Income Tax stood at 13.57% while Personal Income Tax collections stood at 26.91%, also refund of ₹2.77 lakh, as of Feb 10, 2024.

Henceforth, India is witnessing a significant rise in its net direct tax collection for FY 24.

Source: Economic Times

Promoters have been consistently offloading their stakes for over a year now.

IMPACT: NEGATIVE![]()

The data shows that a significant portion of exits have come from Mid-cap and small-cap companies, having an adverse impact on the respective companies’ market value.

Indian promoters tend to acquire shares during a market downtrend and divest during euphoric markets. The current market’s high valuation can be one of the key reasons for the exits happening from the Indian Promoters’ end.

Hence this trend is causing a downward pressure on the respective stock prices as well.

India To Be Added To Bloomberg EM Bond Index In Jan 2025

IMPACT: POSITIVE![]()

Bloomberg's decision to include Indian government bonds in its indices from January 2025 is a positive development, reinforcing confidence in the Indian economy. This move aligns with JP Morgan's earlier announcement of India's inclusion in its emerging market debt index.

The Indian bond market is poised for increased demand due to factors like a stable government, robust economic growth, and peak interest rates, anticipating substantial dollar inflows.

In January alone, Foreign Portfolio Investors (FPIs) injected an impressive $2,387 Mn. (Rs 19,800 cr.) into Indian bonds, marking the highest monthly inflow in six years. Year-to-date until the end of February, FPIs have contributed $5,089 Mn. (Rs 42,256 cr.) to the Indian Debt Market.

Source: NSDL

What you should do. And should not.

![]()

Remain invested in equity in this current volatile market scenario.

![]()

Continue your

investment

systematically in the way of SIP & STP.

![]()

There are opportunities in long-term debt, lock the fund for regular inflow.

![]()

Consider creating cash from mid & small cap equity for short-term requirements.

![]()

Conclusion

Please remember investing is mostly backing quality businesses run by quality managements that offer a runway for strong cash flow growth, earnings potential, and long-term prospects. Buying them at a “reasonable” price with an eye on the returns is important. Stay invested, stay disciplined and secure your returns. We have prepared a sound long term holistic financial plan for you based on your risk profile, defined your financial goals along with you… did an asset allocation (with contingency plans built in) with you. We believe we are in the best objective position to help navigate the vagaries of the market.

Standard Warning & Disclaimer: