+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

March 2024

Positive ![]() Negative

Negative ![]() Neutral

Neutral ![]()

| PARAMETERS, EVENTS | IMPACT | REASON |

| Inflation (CPI - India) | Inflation decreased to 5.09% in Feb, 2024 from 5.10% reached in Jan 2024. | |

| Brent Crude | Brent crude price increased by 5.67% In Mar 2024 | |

|

Currency USD/INR |

Rupee depreciated by 0.54% in Mar, 2024 | |

| FII Inflows | FIIs were Net-buyers of Indian equities to the tune of Rs.35,098 Cr in Mar, 2024 | |

| DII Inflows | DIIs poured Rs.56,312 Cr worth of Indian equities in Mar, 2024 | |

| G-Sec Yield | Yield slightly decreased to 7.05% in Mar, 2024 end from 7.07% in Feb, 2024. | |

| Tax Collection | Record GST collection of Rs.1.48 Lakh Cr in July, 2022. | |

| Global - Inflation | US inflation has slightly decreased at 3.2% in Mar 2024 from 3.5% in Feb 2024 |

| EQUITY MARKETS | IMPACT | REASON |

| Valuations-PE | It stood at 22.88 times in Mar 2024, -23.13% below Oct, 2021 peak. | |

| Valuations-PB | It stood at 3.92 times in Mar 2024, -18.12% below Oct, 2021 peak. | |

| Valuations - Market cap to GDP ratio | India’s market cap stands at 120% of GDP |

High Risk ![]() Moderate Risk

Moderate Risk ![]() Low Risk

Low Risk ![]()

| RISK FOR EQUITIES | LEVEL OF RISK |

| Rising Oil prices & Commodity inflation | |

| Geopolitical tension | |

| FII's being a Net-Seller | |

| US FED - Tightening | |

| US FED - Interest rate hike | |

| RBI-Sucking out liquidity | |

| Current Valuations |

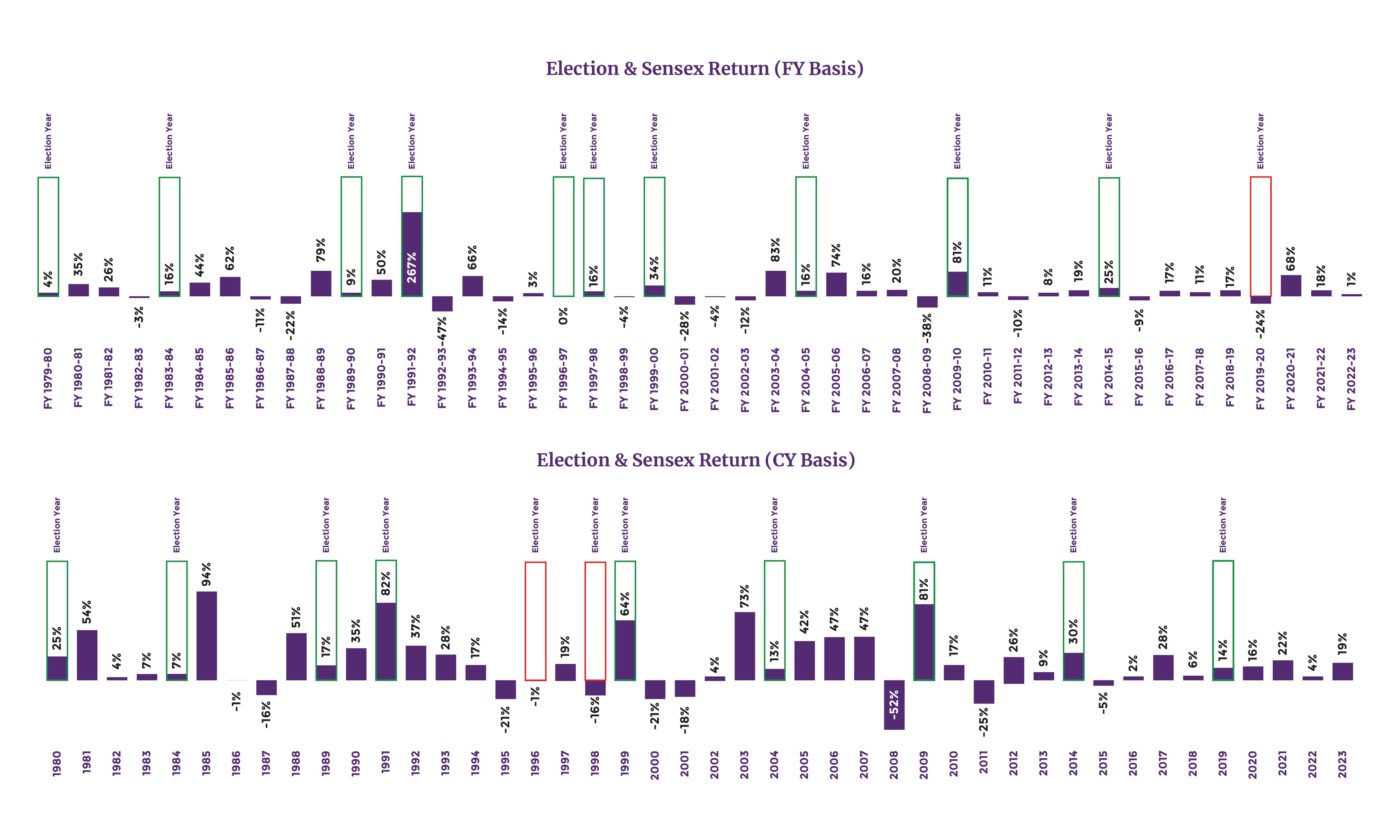

The data show that election years have been good for the Indian equity market.

IMPACT: NEUTRAL![]()

In general, the election’s outcome tends to influence the equity market for a short period, especially when results are announced, there might be short-term volatility but not necessarily for the entire year.

It is usually the news & social media, that hype the election results with the markets because of which investors get panicked or overexcited. But on the contrary, as the data shows, historically, the elections have not had much adverse impact on the markets at the end of its calendar year.

Hence, investors are advised not to chase the hype or get influenced by the news headline. As always, we reinforce maintaining a balanced approach to investing.

As for the US 2024 elections, several significant issues are at the forefront of public discourse, shaping the policy contrasts between candidates Joe Biden and Donald Trump. Abortion, Immigration, Health care, Taxes, Judges & the Supreme Court, Trade and Foreign policy being the seven key areas where their stances differ.

Gold is trading at an all-time high amidst global uncertainties.

IMPACT: POSITIVE![]()

Gold prices are experiencing a historic surge, driven by increased central bank buying, particularly by China. This trend raises critical questions for investors: is this a strategic opportunity or a short-term euphoria?

Gold's role as a hedge against equity market risk is not always straightforward and recent trends may indeed deviate from traditional correlations. Factors such as dollar strength, geopolitical events and changes in interest rates can all influence gold prices in ways that may not align with broader equity market movements.

Oil prices climbed after Iran's attack on Israel, the short-term trend is upward due to the Israel-Hamas conflict.

IMPACT: NEGATIVE![]()

Oil prices climbed after Iran's attack on Israel. Traders are concerned about a potential Israeli response leading to supply disruptions in the Middle East. This adds to existing factors like OPEC+ cuts and geopolitical risks, pushing oil prices higher despite strong global demand.

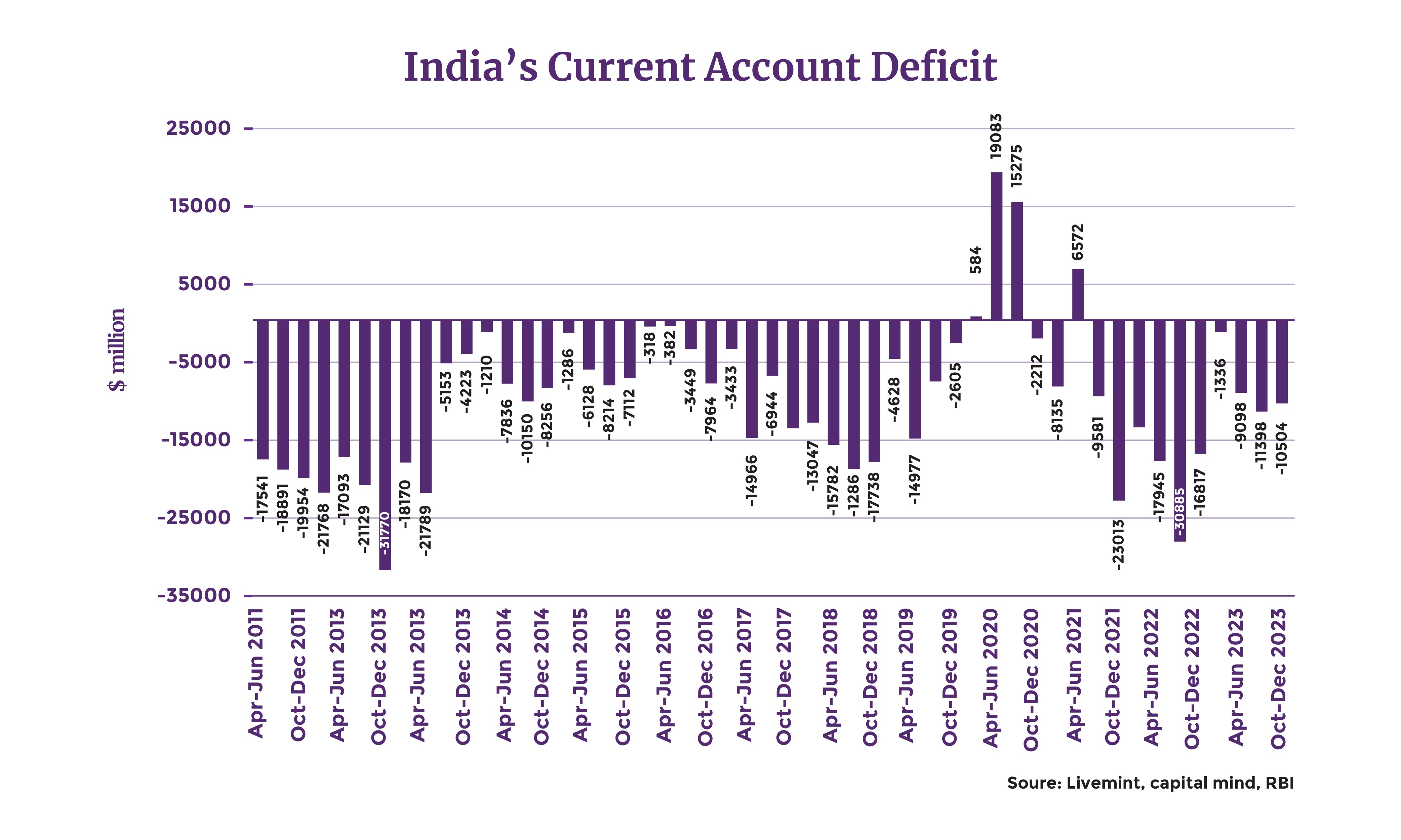

The Q3 Current Account Deficit stands at 1.2% of GDP.

IMPACT: POSITIVE![]()

The Current Account Deficit has narrowed to $ 10.5 billion (1.2% of GDP) in Q3 FY 2023-24 vs $ 11.4 billion (1.3 % of GDP) in the previous quarter and $16.8 billion (2% of GDP) in the previous FY (Q3 FY 2022-23).

As per RBI,

Overall, this narrowing deficit is an indication of strong economic growth prospects for India.

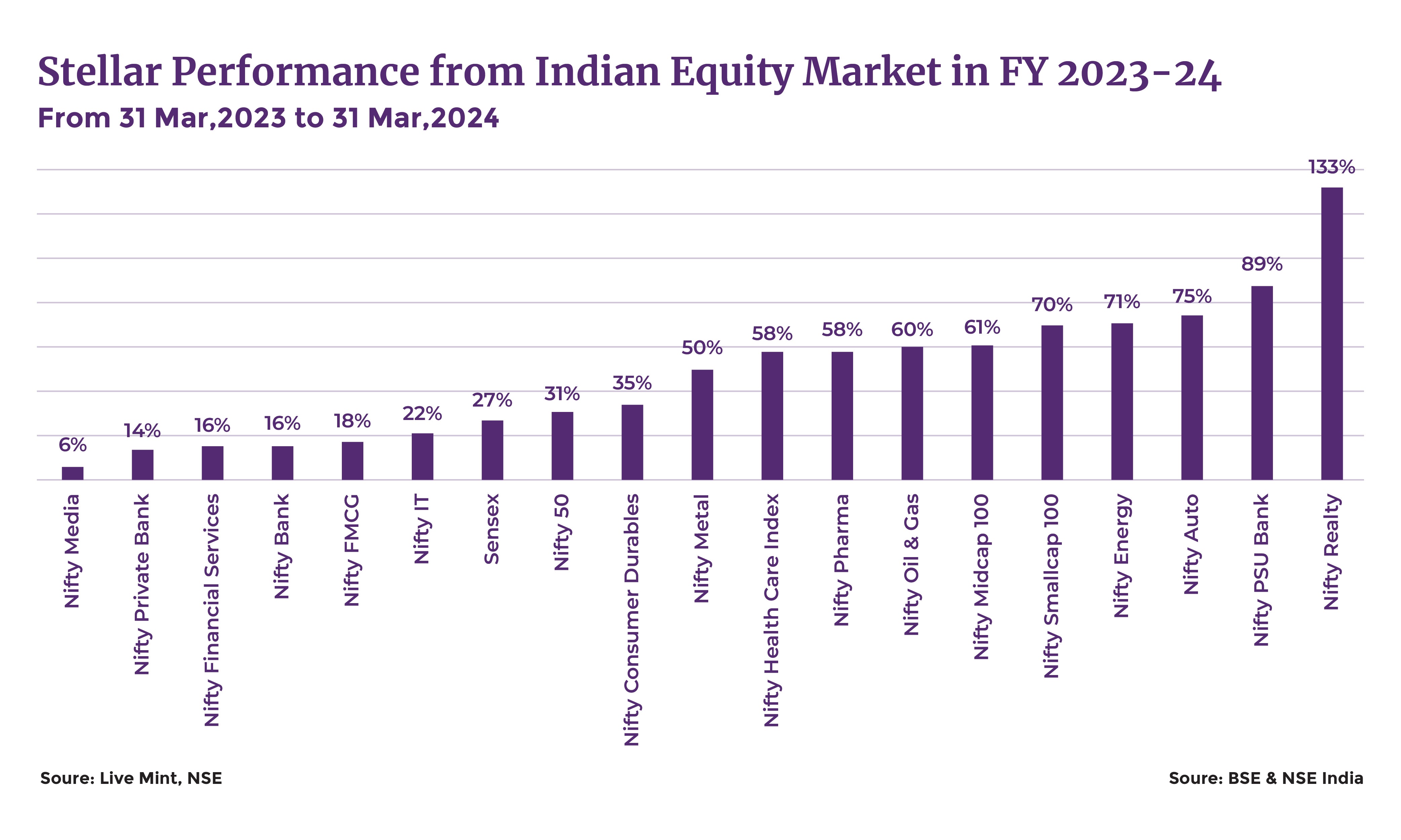

Nifty and Sensex were all up by a record high in the previous FY2023-24.

IMPACT: POSITIVE![]()

India’s Benchmark indices Sensex and Nifty and other sectoral indices have closed FY 24 on a high note. This bullish trend can be attributed to strong economic growth, robust corporate earnings and domestic inflows. Also, it was propelled by widespread buying across various sectors despite challenges such as a depreciating rupee affecting market sentiment.

The data shows the returns generated across the indices in FY 24.

During the fiscal year 2024, the S&P BSE Sensex index has touched multiple record highs, the index has recorded a 25% increase, and the market capitalization of BSE-listed companies surpassed Rs 333 lakh crores, or $ 4 trillion, for the first time ever in November 2023. Since COVID-19 low, the index has given a stellar performance of 187%.

Nifty delivered 31%, the Midcap Index gave 61% and the Smallcap gave 70% returns.

Sectoral Indices like realty, PSU Banks, and Auto have done appreciably well, delivering 133%, 89% and 75% returns respectively.

Overall, FY 24 was an outstanding year for the Indian Stock Markets, outperforming prior years’ performance and generating investors with optimal returns.

India’s power consumption grew 1.4% to 129.89 BU in March.

IMPACT: POSITIVE![]()

As per the government data, India’s power consumption growth remained subdued at 1.4 % to 129.89 billion units (BU) in March 2024 as compared to the year-ago period.

The highest supply in a day (peak power demand) rose to 221.70 GW in Mar 2024 as against 208.92 GW in Mar 2023 and 199.43 GW in Mar 2022.

The Power Ministry had estimated the country’s electricity demand to touch 229 GW during the summer of 2023. However, it did not reach the projected level in April-July due to unseasonal rainfall.

However, as per experts, power demand and consumption may see a significant increase from here onwards as the summer begins unless there is unseasonal rainfall.

Small-cap funds take longer to liquidate compared to mid-cap funds.

IMPACT: NEUTRAL![]()

The stress test calculates the number of days required to liquidate assets based on their recent trading volumes. The objective of this stress test is to ascertain how soon fund managers can liquidate their portfolios if the investors were to rush for redemptions under market downturns or mass redemptions.

AMFI’s stress test data reveals key differences in small-cap and mid-cap fund liquidity.

For 25% liquidation: 0.25 – 30 days.

For 50% liquidation: 60 days for small caps & up to 14 days for Midcap.

What you should do. And should not.

![]()

Remain invested in equity in this current volatile market scenario.

![]()

Continue your investment

systematically in the way of SIP & STP.

![]()

There are opportunities in long-term debt, lock the fund for regular inflow.

![]()

Consider creating cash from mid & small cap equity for short-term requirements.

![]()

Conclusion

Please remember investing is mostly backing quality businesses run by quality managements that offer a runway for strong cash flow growth, earnings potential, and long-term prospects. Buying them at a “reasonable” price with an eye on the returns is important. Stay invested, stay disciplined and secure your returns. We have prepared a sound long term holistic financial plan for you based on your risk profile, defined your financial goals along with you… did an asset allocation (with contingency plans built in) with you. We believe we are in the best objective position to help navigate the vagaries of the market.

Standard Warning & Disclaimer: